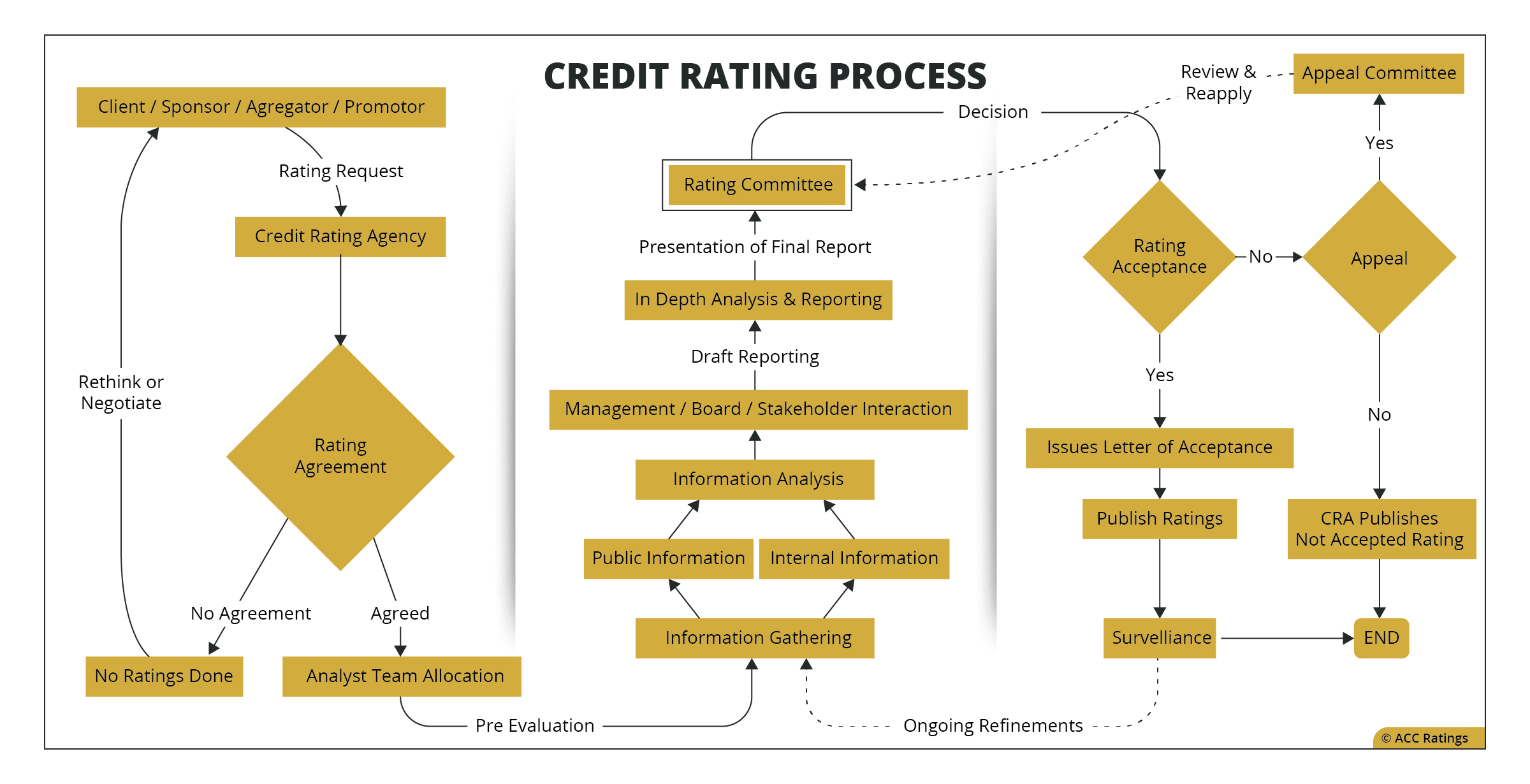

Credit Rating Process

Credit Rating Process is the exercise to gather information, evaluate and rate a business based on standard financial models and methodologies

This week we will explore about Credit Rating Process in brief, with an aim to provide procedure which is followed by Indian Credit Rating Agencies.

- Brief About Rating Process

- Preface of Credit Rating Process

- Main Parts of the Credit Rating Process

- Credit Rating Request

- Rating Agreement

- Analyst Team Assignment

- Public Information Assessment

- Internal Information Assessment

- Management / Board / Stakeholder Interaction

- In Depth Analysis

- Draft Reporting

- Rating Committee

- Ratings Acceptance

- What if we do not accept given ratings?

- Publishing Results

- Ongoing Surveillance

Brief About Rating Process

Corporate Credit rating process is essential part to evaluate the risks associated with any organization. Credit Rating Agencies (CRAs) have sole responsibility of defining these ratings based on highest standards of independence and analytical rigor. Generally, analysis of each credit is carried out by multi-member team which specializes on pinpointing any anomaly in financial, procedural, and business process with years of industrial experience.

Each CRA has their own analytical teams, their own processes to define ratings and are generally out of scope to talk about particulars in details, so in this article we will cover the broad idea of how rating process is implemented. This covers overall model of rating process that is followed with personalized tweaks by CRA in order to serve wide range of businesses.

Preface of Credit Rating Process

Corporate Credit rating process is essential part to evaluate the risks associated with any organization. Credit Rating Agencies (CRAs) have sole responsibility of defining these ratings based on highest standards of independence and analytical rigor. Generally, analysis of each credit is carried out by multi-member team which specializes on pinpointing any anomaly in financial, procedural, and business process with years of industrial experience.

- Banks Internal Credit Ratings

- Credit Rating Agency’s Ratings

Banks usually do internal evaluation for businesses to avail. any credit and they have their analyst team to evaluate business specific criteria apart from CRA given ratings. These ratings are considered as internal ratings of banks and viewed towards bank’s credit risk analysis.

Credit Rating Agency’s ratings on other hand plays pivotal role in defining a business’s credit valuation in open market. Thus, we would primarily focus on CRA given ratings.

Main Parts of the Credit Rating Process

- Rating Request

- Rating Agreement

- Analyst Team Assignment

- Public Information Assessment

- Internal Information Assessment

- Management / Board / Stakeholder Interaction

- In Depth Analysis

- Draft Reporting

- Rating Committee

- Ratings Acceptance

- Publishing Results

- Ongoing Surveillance

For Overview, this is how rating process works :

Credit Rating Process Illustration

Credit Rating Request

First an issuer or a business would contact a rating agency and raise a rating request. Rating request can be initiated between parties and it can be mutually reviewed for initial communication and negotiations about agreement between the stakeholders. The rating request would be in form of formal request initiated by either party. The rating process begins when arranger, issuer, sponsor, or underwriter contacts a member of Business Relationship Management (BRM) with a request to engage in ratings to CRA.

Rating Agreement

CRA and Businesses do have terms defined by regulators which needs to be addressed first. Initial draft of agreement between Business and CRA is drawn in order to sort out any incompetence. The agreement defines the process, requirements, rating criteria, terms, and a legal framework to bind involving entities. This process is carried out by business development team or in common terms business relation managers of CRAs.

Analyst Team Assignment

When the agreement process is completed, an analytical team is assigned the responsibility of analyzing the issuer’s credit risk profile. This rating team (comprising at least two analysts) then collates preliminary information from the issuer to understand its business, management, and financial risk profiles.

The analyst team members are generally experienced financial planners and having executive experience to understand different kind of financial and business risks. Their sole job is to evaluate business on every level and come up with identified risks.

Public Information Assessment

Analysts base their rating analysis on a thorough review of information known to them and believed to be relevant to the analysis and the rating decision in accordance with the applicable criteria. The rating process incorporates information provides directly to CRA by issuer, arranger / sponsor or third party.

This information includes:

- Published Company Financial & Operational statistics

- Reports filed with regulatory intuitions

- Industry & Economic Reports – usually from industry body like industrial unions or business analysts

- Other data & insights

In most cases for solicited credit ratings, the issuer’s management or transaction sponsor participates in the ratings process via in-person management and treasury meetings, on-site visits, teleconferences, and other correspondence. Analysts also consider macroeconomic data, market events and any other information deemed relevant for rating analysis, such as data from an issuer’s peers, data provided by other analytical groups within Fitch or publicly available information.

Internal Information Assessment

Analysts collectively base their rating analysis that may include requirement of disclosing non-public information. This information is requested if found appropriate by CRA in order to perform pre-analysis. Requested non-public information can include:

- Information provided directly by the issuer, arranger, sponsor, or other involved party

- Background data, forecasts & other communication

The analytical team conducting the analysis will determine if sufficient information is available to form a view on the creditworthiness of the issuer. The rating committee will also consider whether there is sufficient information to assign a credit rating. If CRA believes that the information available, both public and private, is insufficient to form a rating opinion, credit rating request may be rejected and timely published of rejection by some CRA.

Management / Board / Stakeholder Interaction

Ratings are all based on trust worthiness and it’s strongly believed that investor interest is best served along with an open dialogue between all stakeholders. The management interaction allows CRA to explore non-public information. The information helps CRA to conclude its final rating decision and allows them to calculate forward looking ratings. This is especially beneficial for all stakeholders at once.

The mode of management interactions cans be face-to-face meetings on premises, site visit and/or teleconference, when appropriate. Discussion during these interactions are wide-ranging covering competitive position, strategy, financial policy, historical performance, and near and long-term financial and business prospects. With these discussions CRA analysts focus on business risks and financial projections that are responsible for performance of a business. It serves as valuable input to issuer’s profile as they shed light on management’s assumptions, strategy, and contingency plans.

In Depth Analysis

Credit ratings are assigned and reviewed through a committee process. The analysis required beforehand includes a complete application of sector-specific rating criteria and methodologies, including but not limited to:

- Determine if information is robust enough to ensure CRA can form a view or opinion on the creditworthiness

- Assess Key rating Drivers according to applicable master or sector criteria

- Develop or apply rating model where applicable

- Quantitative and qualitative analysis performed in line with criteria

- Position credit assessment against key peers through an in-depth Peer Analysis

- Develop Ratings Navigator (where applicable to sector).

- Consider the impact of economic, social and governance (ESG) risk on CRA

Some of the analysis can go under Screening Committee (SC) in CRAs whose job is to identify if full rating process should be carried out or not. This committee can be part of analyst team or separate team analyzing same criteria and provides initial layer of review to consider rating proposals and their feasibility.

Draft Reporting

Once information has been collected and the issuer and/or securities analyzed in accordance with CRA criteria and methodologies, different analyst team assigned to rating process will form a rating recommendation and document their analysis and rationale in an internal draft.

The draft must contain sufficient content, consistent with the methodology and criteria that apply to the analysis, to provide a solid basis for the recommended credit rating. The draft must include a summary of key rating drivers, sensitivity analysis, criteria variations (if any), and details of reasonable investigation, amongst certain other minimum content.

Rating Committee

After analysts prepare a draft report detailing their assessment of business risk, financial risk, and management risks associated with the issuer. The report is based on rating methodologies and criteria that are clearly spelt out, published, and consistently applied. The report is then presented to the rating committee. This is the only aspect of the process in which the issuer does not directly participate. The rating committee comprises experienced professionals who bring with them extensive experience in credit assessment. The rating committee assigns a rating after thorough discussion on the report prepared by the analysts.

The Rating Committee Meeting (RCM) process ensures objectivity of the rating, as the decision results from the collective thinking of a group of experienced professionals. The RCM process also ensures high quality and consistency of analysis because the reports and discussions are focused on key rating factors that are relevant to the issuer. If CRA and the issuer have any common directors, such directors do not participate in the RCM or rating process. A disclosure to this effect is also made with the announcement of the rating.

Other factors that should be considered:

- Consensus decision on appropriate rating, including, where appropriate, a Rating Outlook or Rating Watch designation

- Minimum size for committee is four analysts

- Committees frequently include analysts from outside the immediate asset class, sub-sector or geography since peer analysis is a central element of the process

- A rating committee may adjust (or vary) the application of the criteria to reflect the risks of a specific transaction or entity. All such criteria variations are disclosed in the respective rating action commentaries; including their impact on the credit rating (if any) analysis is a central element of the process.

Ratings Acceptance

Once the RCM concludes, the outcome is communicated in writing a document (rating rationale) highlighting the key reasons for assigning the rating is shared with the issuer to the issuer or, where applicable, its arranger/sponsor/ agent (exceptions apply). This is to assist the issuer in understanding the key analytical factors that have been assessed for arriving at the rating decision.

Issuer can accept the given rating by sending Letter of Acceptance to CRA. This concludes main part of rating process.

What if we do not accept given ratings?

If, on the other hand, the issuer disagrees with the rating decision, it can appeal for a fresh look at the rating assigned. In such a case, the issuer needs to submit additional facts, data, or new information to the ratings team, to be presented to the rating committee. Such information must be material to the appeal, and should ideally address areas that have been highlighted as factors constraining the rating in the rating rationale. This would allow businesses to re-evaluate their ratings.

In Indian context, pursuant to SEBI circular titled ‘Amendment to SEBI (Credit Rating Agencies) Regulations, 1999 and modification to SEBI Circular dated May 30, 2018’ dated September 19, 2018, an appeal is considered by arating committee majority of whose members are different from the one which assigned the rating, and comprises at least one-third independent members. The rating committee then discusses the information submitted. It may or may not change the rating, depending on the facts of the case. If the rating is not changed and issuer continues to disagree with the rating, then the issuer has an option of not accepting the rating. In line with SEBI guidelines, the unaccepted ratings are disclosed on CRA website.

Publishing Results

The accepted ratings are disseminated to CRAs subscriber base, and to local and international media. Rating information is also updated online on CRA website in digital way, in the form of a rating rationale, which provides information about the company, rated instrument, assigned rating and outlook, rationale for assigning the rating, applicable criteria, etc.

Also, CRA may in compliance with International Organization of Securities Commission (IOSCO) code of conduct, publish a more detailed credit rating report (CRR) on its dedicated website. The publication of the CRR ensures transparency in CRAs rating methodologies and assumptions and enables investors to understand how CRA arrives at a rating.

Ongoing Surveillance

Credit Ratings are typically monitored on an ongoing basis and the review process is a continuous one. Monitored credit ratings are also subject to a review by a rating committee, at least once annually. Certain sovereign and international public finance credit ratings are reviewed at least every six months, according to a calendar of scheduled review dates.

Analysts will convene a committee to review the credit rating instead of waiting for the next scheduled review if a business, financial, economic, and operational or other development can reasonably be expected to result in a rating action.

Keep reading: Read more about Credit Risk Assessment Framework

Pingback: Withdrawal of Ratings - Amrut Corporate ConsultingAmrut Corporate Consulting